Copper in massive demand supply future

Copper in massive demand supply future

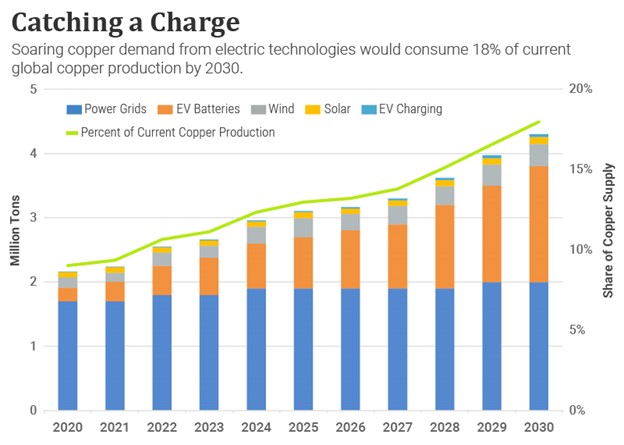

The Canadian metals mining firm, Teck Resources Ltd. (TECK), predicts that copper demand for EV battery production will jump 750% this decade – from 210,000 tons in 2020 to 1.8 million tons.

Alongside that surge, Teck predicts copper demand for EV charging stations will soar more than 1,000% by 2030.

All else being equal, therefore, copper prices should trend higher for several years. But all else is not equal…

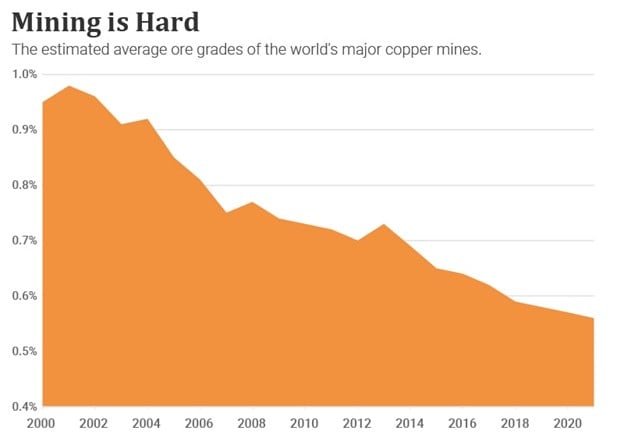

The copper supply is under extreme geological pressure; ore grades at the world’s major copper mines are declining. Australian-U.K. resources company BHP Group (BHP) estimates that declining grades will remove around two million tons/year of global copper mine supply by 2030.

That’s no small matter. As ore grades decline, copper supplies do not merely become less plentiful; they also become more expensive to extract.

Consider this back-of-envelope analysis from Manhattan Institute Senior Fellow, Mark P. Mills…

For every ton of a purified element, a far greater tonnage of ore must be physically moved and processed. That is a reality for all elements, expressed by geologists as an ore grade: the percentage of the rock that contains the sought-after element…For a snapshot of what all this points to regarding the total materials footprint of the green energy path, consider the supply chain for a single electric car battery, which in final form weighs about 1,000 pounds. Providing the refined minerals needed to fabricate a single EV battery requires the mining, moving, and processing of more than 500,000 pounds of materials somewhere on the planet.

Bottom line: Robust future demand growth for copper is fairly certain, but the mining industry’s capacity to satisfy that growth is not. That’s the sort of equation that should put upward pressure on the copper price for many years to come.

Comments

Post a Comment