Spike in industrial metals in 2023

Spike in industrial metals in 2023

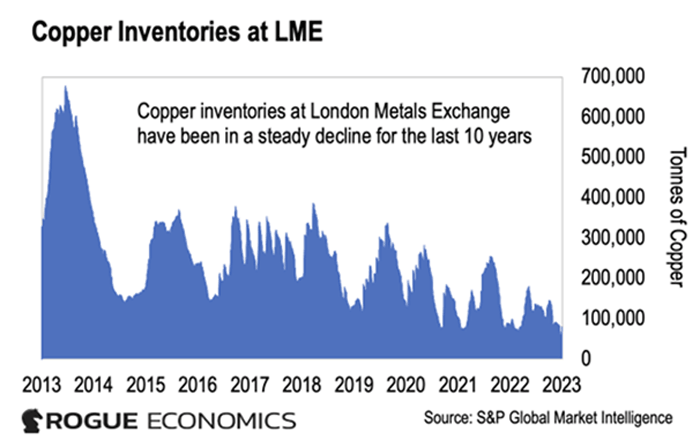

But take a look at the chart below. You’ll see copper inventories at the London Metals Exchange have been on the decline since mid-2013. This exchange is the most important in the world for industrial metals trading.

And then there’s nickel. Nickel is mostly used to make stainless steel, a key construction material.

In recent years, nickel also became a vital part of lithium-ion batteries. These power a wide range of devices, from smartphones to electric vehicles.

But take a look at this next chart below. It shows that nickel is down significantly since 2015.

In 2015, inventories reached 470,000 tonnes. Today, there are only 54,000 tonnes at the London Metals Exchange.

That’s a giant 88% drop in over eight years.

These key metals face massive deficits – some of the worst we’ve seen in decades.

This is a lagging effect of the economic distortion that started during the pandemic.

In the last two years, almost no one has been developing new mines… or searching for new copper or nickel projects. A lot of miners halted production during the pandemic, too.

Also, mining and smelting are power-intensive. And the Russian-Ukraine War led to a massive rise in energy costs. Some miners were forced to shut off their operations until energy prices returned to normal.

This has created a gap in the supply chain that we’re now facing.

And thanks to the U.S. government, that gap could get even bigger over the next few years.

Last year, the White House signed a $1.2 trillion infrastructure bill. The funds will go toward updating highways, bridges, power grids, energy storage, and much more.

Most of these require significant volumes of raw materials – including nickel and copper.

Copper, Nickel and Zinc will explode as supply will not match the demand for infrastructure, EV vehicles, housing and migration away from fossil fuels.

Comments

Post a Comment