Over negative, sees a positive

Over negative, sees a positive

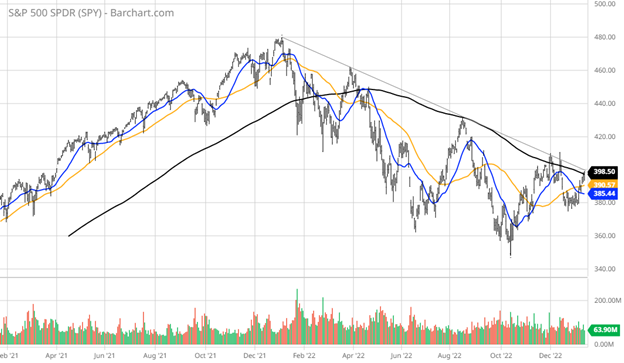

Lastly, the S&P 500 closed barely above its 200-day moving average. This fact is getting a lot of technical chatter, but the prior four attempts to break out failed. All of this makes this attempt off of a higher low somewhat more encouraging. I think it will take a wave of companies providing assurance about business conditions for the current quarter and further out to see a clean break above this key trend line. If this succeeds, this action will send the bears back to their caves.

As of the third quarter of 2022, Americans hold $925 billion in credit card debt, which is a rise of $38 billion since Q2 2022. The Federal Reserve of New York says this is a 15% year-over-year rise -- the biggest jump we've seen in more than 20 years. How this will all play out next month will be intriguing, given the U.S. is a consumer-driven economy. But for now, unemployment is at 3.5%, inflation is coming under control and the market is voting with both feet that a recession is going to be averted. Now, its up to earnings season to keep the party going.

This debt is still on historically low-interest rates and how much of this debt is paid off monthly as people are savvier in using credit cards to get protection and use savings efficiently.

The full world is coming back and orders are being made, the market corrected massively last year, and this year with interest rates biting the market is ready to burst on the upside with whales ready to pick up cheap, interest-bearing stocks. The USA bills passed will mean that all areas of the economy will be stocked for the upside.

Comments

Post a Comment