Outlook 2023

1. Real Disposable Incomes are Poised to Go Up in 2023, Not Down

A historically strong labor market pushed wages higher in 2022. Nevertheless, real disposable income fell sharply in the first half of 2022 because of fiscal tightening and high inflation. In other words, Americans were making more in 2022 but had less purchasing power, which isn’t a good setup for sustainable growth.

Looking ahead to 2023, ongoing strength in the labor market is likely to continue supporting higher wages, while inflationary pressures should subside significantly. We’re already seeing the latter – price pressures related to supply chain disruptions have almost entirely faded, giving way to falling costs for semiconductors, used cars, gas, appliances, and a range of other goods that contributed significantly to last summer’s inflation surge.

In my view, falling inflation combined with rising wages could push real disposable income up by 2% to 3% in the new year, which would buttress consumer confidence and lead to increased spending. As I wrote later last year, since spending accounts for roughly two-thirds of U.S. economic output, strong consumer finances could help the U.S. avoid recession.

2. Job Losses and Rising Unemployment May Not Be Needed to Tamp Inflation

As mentioned in the previous section, “goods” inflation is trending solidly in the right direction, with further declines almost assured in the first half of 2023. But it is also true that one of the Fed’s biggest concerns is not ‘goods’ inflation—which it acknowledges is improving—but ‘services’ inflation, which tends to have closer ties to the jobs market and wages.

In comments following the Fed’s December meeting, Chairman Powell said “the labor market continues to be out of balance, with demand substantially exceeding the supply of available workers.”5 This imbalance puts upward pressure on wages, which can entrench inflation if it influences companies to raise prices to make up for higher costs.

So, many forecasters think the Fed will not stop monetary tightening until it sees significant cooling in the labor market. But in my view, this feat can be accomplished not by triggering massive layoffs, but by instead unwinding available job openings – which would be much less painful.

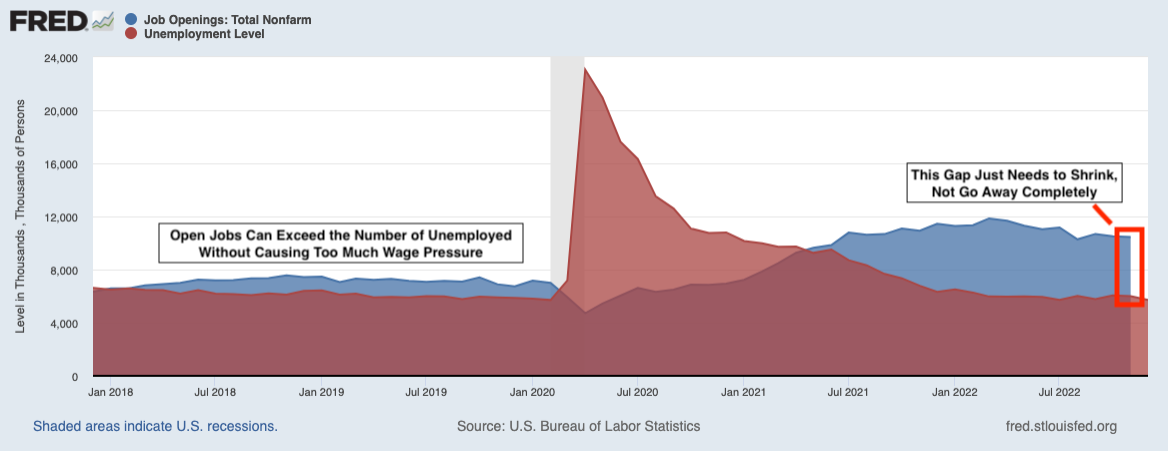

A key feature of this economic fundamental I think many miss: the number of Americans looking for work doesn’t have to exceed the number of available jobs in order for wage pressures to ease. As seen in the chart below, from 2018 up to the pandemic, there were roughly 1.5 to 2 million more open jobs than available workers, and wage pressure was low during that time. In the current environment, I think the ratio of open jobs to available workers only needs to shrink to 2 million (from the current 4 million) to bring wage growth down to a rate compatible with the Fed’s 2% inflation target:

3. China’s Economic Reopening Supplying Global Economic Tailwinds

The end of China’s “zero Covid” policy has so far been bumpy. China does not supply reliable data in terms of hospitalizations and how broadly the spreading of infection is disrupting daily life and economic activity. But safe to assume it has so far been hurting more than it’s been helping.

I think that could change later in 2023. While China currently lacks natural immunity and vaccines there are not as effective, over time the impact on day-to-day life is likely to subside much as it has in the U.S. China’s government has also been hinting at the possibility of stimulus to boost the economy, and there are several indicators that regulatory hostility towards hard-hit technology and education sectors could abate in the new year.

China is the second largest economy in the world, so a snap back to stronger growth trends would serve as a tailwind to global GDP and likely boost other emerging market economies.

Comments

Post a Comment