Inflation Continues to Cool

Inflation Continues to Cool

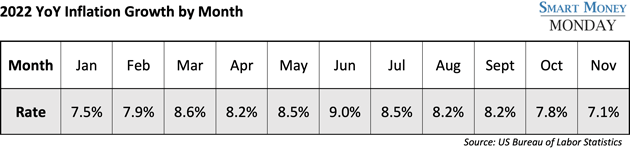

The first storyline for 2023 really emerged at the end of 2022. That is, inflation—as defined by the Bureau of Labor Statistics—is beginning to cool.

I told readers back in September that our inflation nightmare would flatline in six months. I took a lot of heat for that. Many readers didn’t believe it. But it was obvious then, and it’s obvious now.

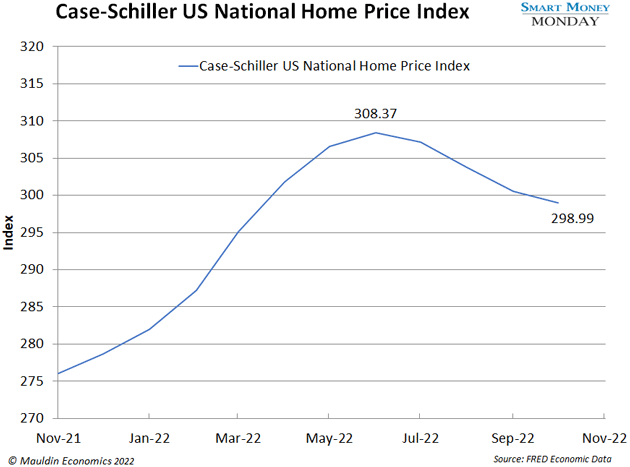

A quick recap: Shelter represents one-third of the weight of the CPI-U. Shelter is a quirky calculation based on rent and “owners equivalent” rent, which is a way to approximate inflation felt by homeowners.

The shelter calculation is a lagging indicator. Home prices and rent prices have been falling for the past few months, and yet these declines aren’t showing up in the inflation reading. At least, not yet.

But it’s starting to filter through, and I expect we’ll see it really start to show up in March 2023.

Another area where prices are set to cool is with retailers.

These companies simply have way too much product. Target (TGT) and Lululemon (LULU) saw their inventories grow 14.4% and 84.5% year over year, respectively. Expect discounting as they work to clear existing inventory, which is deflationary, not inflationary.

And at the ports, well, the backlog of containers is gone. And container shipping rates? Back to normal.

Comments

Post a Comment