Come in the water is lovely, it might be a bit choppy

Come in the water is lovely, it might be a bit choppy

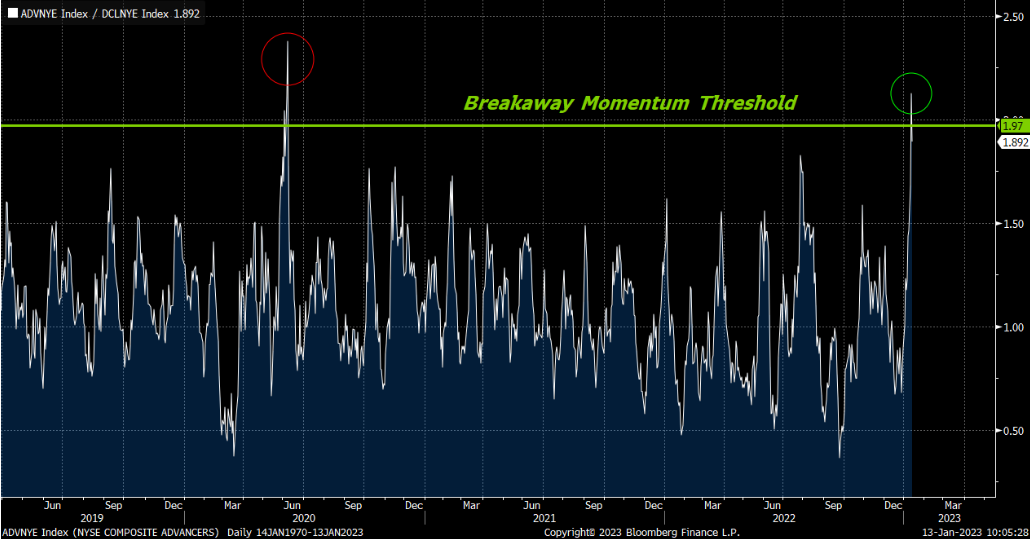

On Thursday, that ratio of advancing to declining stocks on the NYSE broke above 1.97. Throughout this entire bear market, this is the first breakaway-momentum period for stocks. The last time was in June 2020, when we burst out to a major rally..

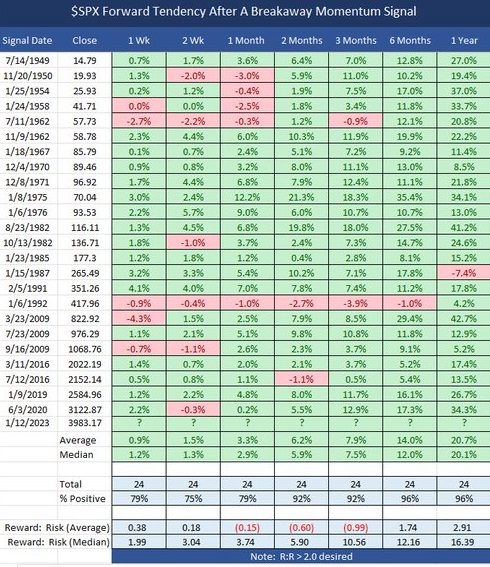

Historically, this is very significant. This is just the 25th time over the past 75 years that the stock market’s Breakaway Momentum indicator has been triggered. In each of the previous 24 times this indicator was triggered, stocks were higher six to 12 months later – every time. Let me repeat that. Through 75 years of data and 24 different signals, the Breakaway Momentum indicator has 100% certainty of predicting big stock market rallies. And the average returns over the following 12 months? More than 20%.

That indicator just flashed two days ago.

This is the time to ease back into the market but still have the game plan of cutting losses and letting winners grow. The whales are coming into the market and will create a general tidal increase. Make sure that you avoid Zombie companies and choose sector rotation.

Comments

Post a Comment