Fed Cuts Rates

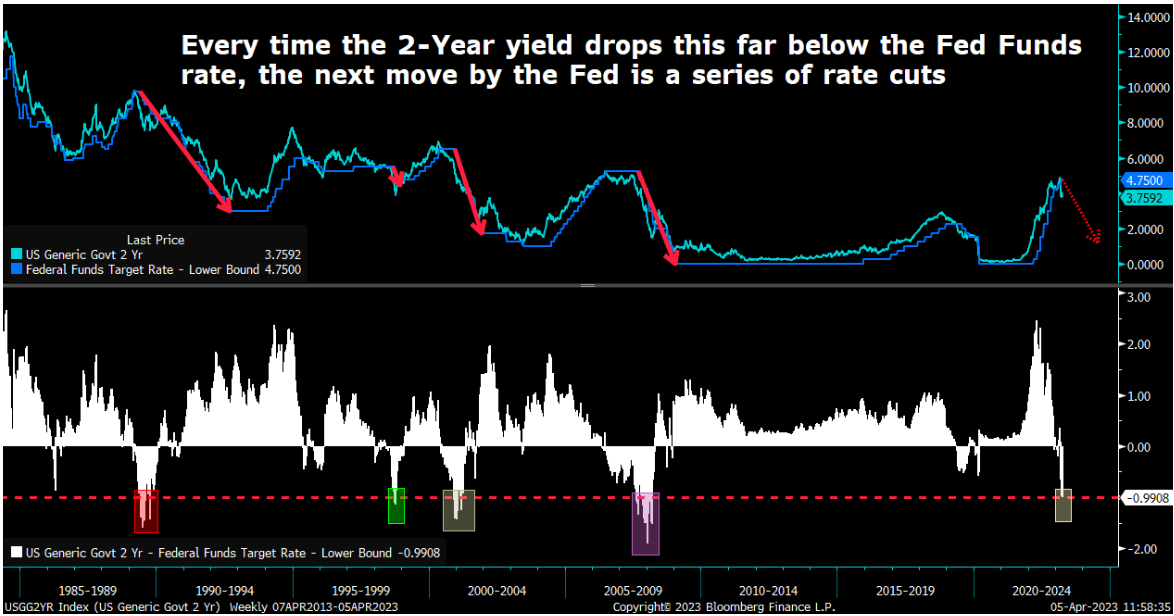

Historically, every time this has happened before, a Fed pivot was imminent.

That is, every single time the 2-year Treasury yield has dropped more than 100 basis points below the Fed Funds rate, the Fed went from hiking rates to cutting them.

For all the talk of rate hikes from various Federal Reserve members, the bond market is telling the Fed that it has no more room to hike. It’s time to cut. The Fed will listen to the bond market. It always does, as the chart above shows. Every time the bond market tells the Fed this loudly that it needs to cut rates, the Fed ends up cutting.

Comments

Post a Comment