Copper is in great demand for the future

Copper is in great demand for the future

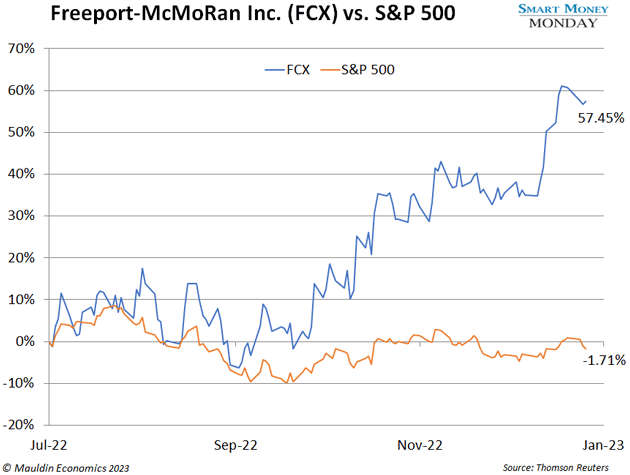

Since recommending the stock, shares are up over 57%, while the S&P 500 is near flat over that same period.

The thesis for buying Freeport was straightforward:

It successfully survived COVID, which nearly killed the company. In fact, many analysts expected the company to go bankrupt. It didn’t.

The supply/demand dynamics for copper are strong. Demand is expected to grow from EVs and power grid upgrades. Supply is flat to declining. Economics 101 says copper prices must go higher. That’s starting to happen, but they still have a long way to go.

Its valuation: In July 2022, Freeport traded for just 10 times 2023 earnings estimates. That’s cheap.

Comments

Post a Comment