Better invested than totally out

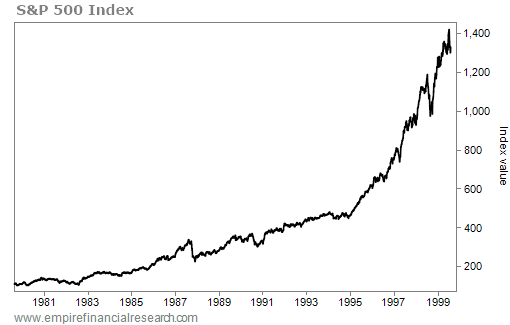

While the market can go down and stay down for extended periods, it's up substantially from each of those disasters. Or to put it in perspective... From its lows in 1974, the S&P 500 is up nearly 7,000%. So much for the death of equities.

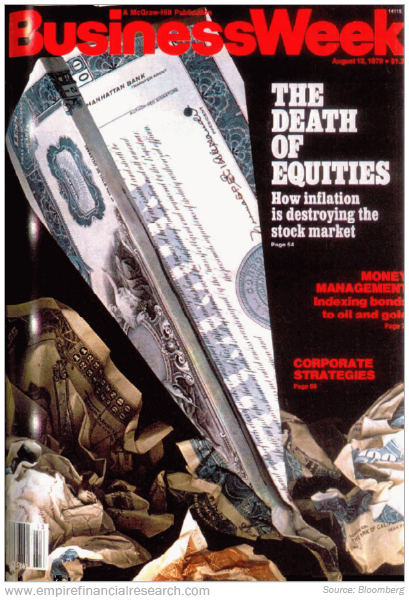

BusinessWeek magazine ran its infamous headline, "The Death of Equities," with the subtitle, "How Inflation is Destroying the Stock Market"...

|

But look at what the S&P 500 did in the next two decades after that BusinessWeek issue...

|

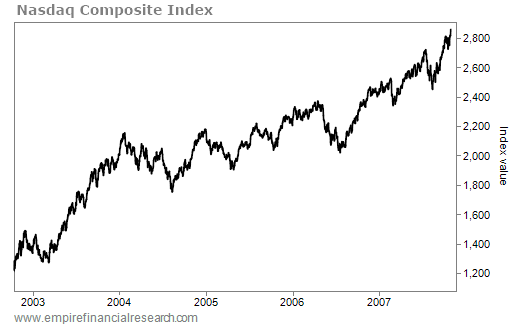

I was at TheStreet.com working alongside Jim Cramer in 2000 when the dot-com bubble burst. I remember the panic well – from its peak in March 2000 to the bottom in October 2002, the tech-heavy Nasdaq Composite Index collapsed 78%.

But over the next several years leading up to the next crash, take a look at the recovery...

|

The point here isn't calling tops and bottoms... I'm saying that I've been there, I've seen it all, and now that I'm 70, I'm taking everything I learned and sharing that with anybody who will listen.

Comments

Post a Comment